The economics of climate change are more than abstract numbers: they are a powerful narrative of risk, responsibility, and opportunity. As global temperatures rise, societies face mounting costs from physical damage, market distortions, and disrupted livelihoods. Yet within this challenge lies an unprecedented chance to redirect our economies toward sustainability, resilience, and shared prosperity.

Definition and Causes

Climate change refers to long-term shifts in temperature and weather patterns, largely driven by human activities. Burning fossil fuels at an industrial scale, deforestation, and certain agricultural practices release greenhouse gases that trap heat in our atmosphere. Over decades, these emissions accumulate, leading to changes in rainfall, sea levels, and the intensity of extreme weather events.

Understanding the root causes is the first step toward meaningful action. By identifying how daily choices and policy frameworks contribute to emissions, stakeholders can target interventions that align economic incentives with environmental stewardship.

Measuring the Costs of Inaction

The Stern Review famously described climate change as the greatest market failure ever seen. When carbon emissions go unpriced, markets fail to account for future damages. Recent studies now estimate that a 1°C rise in global temperature could shrink world GDP by 12%—six times higher than earlier projections.

Business-as-usual warming threatens a 25% welfare loss, while the social cost of carbon has climbed to $1,367 per ton. By mid-century, unchecked temperature increases could reduce the global economic value by 10%, with annual costs up to 5% of global GDP—and potentially 20% under severe impact scenarios.

Sectoral Impacts Across Regions

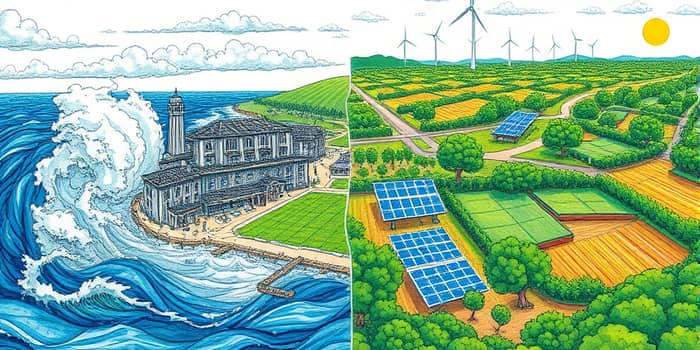

Physical and transition risks manifest differently across sectors and geographies. Coastal regions face sea-level rise and storm surge, while inland farmers contend with shifting precipitation and prolonged drought.

South and Southeast Asia remain among the most vulnerable due to dense populations and limited adaptive capacity. Advanced economies can mobilize resources more effectively, yet they are not immune to supply chain disruptions and insurance market pressures. The United States, for instance, may incur annual losses of $296 billion at 2.8°C warming, rising to $520 billion at 4.5°C.

Market Failure and Policy Responses

Transitioning to a low-carbon economy carries its own financial risks. Asset values may be stranded, industries must adapt technologies, and regulatory shifts can create sudden cost pressures. However, effective market instruments—carbon taxes, emissions trading schemes, and performance standards—can internalize externalities, making pollution expensive and clean alternatives attractive.

Swift, coordinated public and private action is crucial. Governments need to set clear carbon pricing signals, while businesses must integrate climate risk in decision-making. Insurers and reinsurers play a key role in transferring risk and offering incentives for resilience improvements. Together, these actors can transform market failure into an engine for low-carbon growth.

Adaptation and Mitigation Strategies

Preparing for the economic realities of climate change involves two complementary pathways: adaptation to unavoidable impacts and mitigation to prevent catastrophic warming.

- Invest in resilient infrastructure: Upgrade coastal defenses, retrofit buildings for heat and flood resistance, and modernize power grids.

- Scale clean energy deployment: Accelerate solar, wind, and energy storage installations to replace fossil fuel generation.

- Reforest and restore ecosystems: Natural carbon sinks like forests and wetlands provide multiple co-benefits for biodiversity, water regulation, and livelihoods.

Governments must pair regulations with incentives: subsidies for green technology, public procurement of low-carbon products, and support for research into carbon removal. Private investors can channel capital into sustainable ventures, financing innovation and job creation.

Collaborative Global Solutions

Climate change transcends borders, linking the fate of communities across the world. Interconnected global supply chains mean that a drought in Southeast Asia can ripple through manufacturing hubs in North America or Europe. Hence, international cooperation is indispensable. Technology transfer, climate finance, and shared standards enable developing countries to leapfrog carbon-intensive development pathways.

Multilateral agreements like the Paris Accord set common goals, but ambition must be matched by implementation. Richer nations have a moral and economic incentive to aid vulnerable regions: adaptation investments now can prevent staggering future aid expenditures and preserve stability.

A Call to Collective Action

The economic stakes of climate change are staggering, but the benefits of early, decisive action vastly outweigh the costs of delay. Every sector has a role to play—from farmers adopting climate-smart agriculture to financiers embedding climate risk into portfolios.

- Businesses should conduct climate stress tests, set net-zero targets, and innovate low-carbon products.

- Policymakers must strengthen carbon pricing, ensure resilient infrastructure funding, and support a just transition for workers.

- Individuals can reduce personal carbon footprints, support sustainable brands, and engage in community resilience efforts.

By embracing both adaptation and mitigation, societies can transform climate-related economic challenges into opportunities for growth, equity, and innovation. The path forward is demanding, yet it promises a future where economies thrive in harmony with the natural systems that sustain us.

The time to act is now. With informed policies, responsible markets, and global solidarity, we can prepare for the future—and build an economic system that works for people and planet alike.

References

- https://www.epa.gov/environmental-economics/economics-climate-change

- https://www.brookings.edu/articles/ten-facts-about-the-economics-of-climate-change-and-climate-policy/

- https://www.lse.ac.uk/granthaminstitute/publication/the-economics-of-climate-change-the-stern-review/

- https://news.climate.columbia.edu/2019/06/20/climate-change-economy-impacts/

- https://www.swissre.com/institute/research/topics-and-risk-dialogues/climate-and-natural-catastrophe-risk/expertise-publication-economics-of-climate-change.html

- https://www.nber.org/papers/w32450

- https://www.un.org/en/climatechange/what-is-climate-change

- https://en.wikipedia.org/wiki/Stern_Review